-

Aviation Advisory

At Grant Thornton, we have been immersed in the industry throughout a relatively recent period of unparalleled growth resulting in one of the largest aviation advisory teams in Europe. Through the vast experience we have gained, we offer leading expertise across our aviation advisory, aviation tax and aviation audit service lines.

-

Business Risk Services

Our Business Risk Services team leverage our risk, internal audit and technology subject matter expertise to critically assess your governance, risk and internal control mechanisms, thus helping you to better manage risk and enable more informed decision making.

-

Consulting

Whatever your business needs, our Consulting team can help you to move forward and identify and implement major transformations efficiently and effortlessly.

-

Financial Accounting and Advisory Services (FAAS)

As organisations expand into new markets or undertake functional financial transformations, the challenges faced by their accounting and finance teams become more complex. The Financial Accounting and Advisory Services (FAAS) team at Grant Thornton is a multi-disciplinary team that designs and implements creative solutions to address these complexities.

-

Fintech

Our Fintech team will be offering you an opportunity to sit with our experienced consultants to discuss your challenges.

-

Forensic Accounting

Organisations may undergo some type of dispute or internal investigation during their lifetime. Our Forensic Accounting team can seek evidence that can make the difference between finding the truth or being left in the dark.

-

Risk Advisory

Our Risk Advisory team delivers innovative solutions and strategic insights for the Financial Services sector, addressing disruptive forces, regulatory changes, and emerging trends to enhance risk management and foster competitive advantage.

-

Sustainability Desk

We recognise that businesses are operating at different levels of maturity when it comes to sustainability, and pride ourselves on working with our clients to develop bespoke solutions to their exact needs.

-

Company Tax

Our tax team is made up of highly experienced professionals who work with our clients to ensure they are compliant with all aspects of their corporation tax obligations by gaining a deep understanding of the businesses.

-

Global Mobility

Grant Thornton offer a different approach to managing global mobility. We have brought together specialists from our tax, global payroll, people and change and financial accounting teams

-

Indirect Tax

Our Indirect Tax team helps businesses manage their IOM, UK and global indirect tax risks which, as transactional taxes, can quickly become large liabilities.

-

International Tax

We work closely with our colleagues globally to provide a seamless multi-jurisdiction service offering which ensures clients have an appropriate tax structure that mirrors what they are doing operationally – a key consideration in a world where it is no longer possible to separate a company’s tax and operational presences.

-

Private Client

Our team of experienced advisors can assist and navigate you through the tax issues arising when establishing a business, moving to the Island, leaving the island, passing on wealth alongside residence and domicile issues. We can help minimise the impact that taxes, such as income tax, capital gains tax and inheritance tax, may have upon your personal wealth.

Whether discussing investment products, credit offerings or regulatory requirements, the financial services industry is characterised by increasing complexity.

Financial institutions are critically dependent on accurate risk modelling to keep pace with this increasing complexity as ‘data-driven’ approaches affect institutions’ business strategies, risks, operations and regulatory obligations.

Why Grant Thornton

At Grant Thornton, our Financial Services Advisory group of some 225 experts provides market-leading risk, advisory, project management and consulting services globally to leading domestic and international financial institutions. Our Quantitative Risk team comprises more than 20 specialists educated to postgraduate level in relevant disciplines including Mathematics, Statistics, Engineering, Computer Science and Econometrics.

Our reputation for providing best-in-class data analytics and quantitative risk support to financial institutions reflects our team’s success in delivering the development, deployment and validation of key risk models and risk measurement methodologies for a range of Institutions including pillar and subsidiary banks, non-bank lenders, funds, and investment vehicles. Our depth of experience means we know what the key issues challenging today’s risk professionals are whether in the model development or validation stage, or indeed in on-going system management.

Grant Thornton’s extensive pool of experienced quantitative risk experts and customer-focussed service delivery approach means we have a unique capability to deliver results for our clients. Our team of professionals has a wealth of international expertise, a global support network and deep subject matter expertise.

Our Services

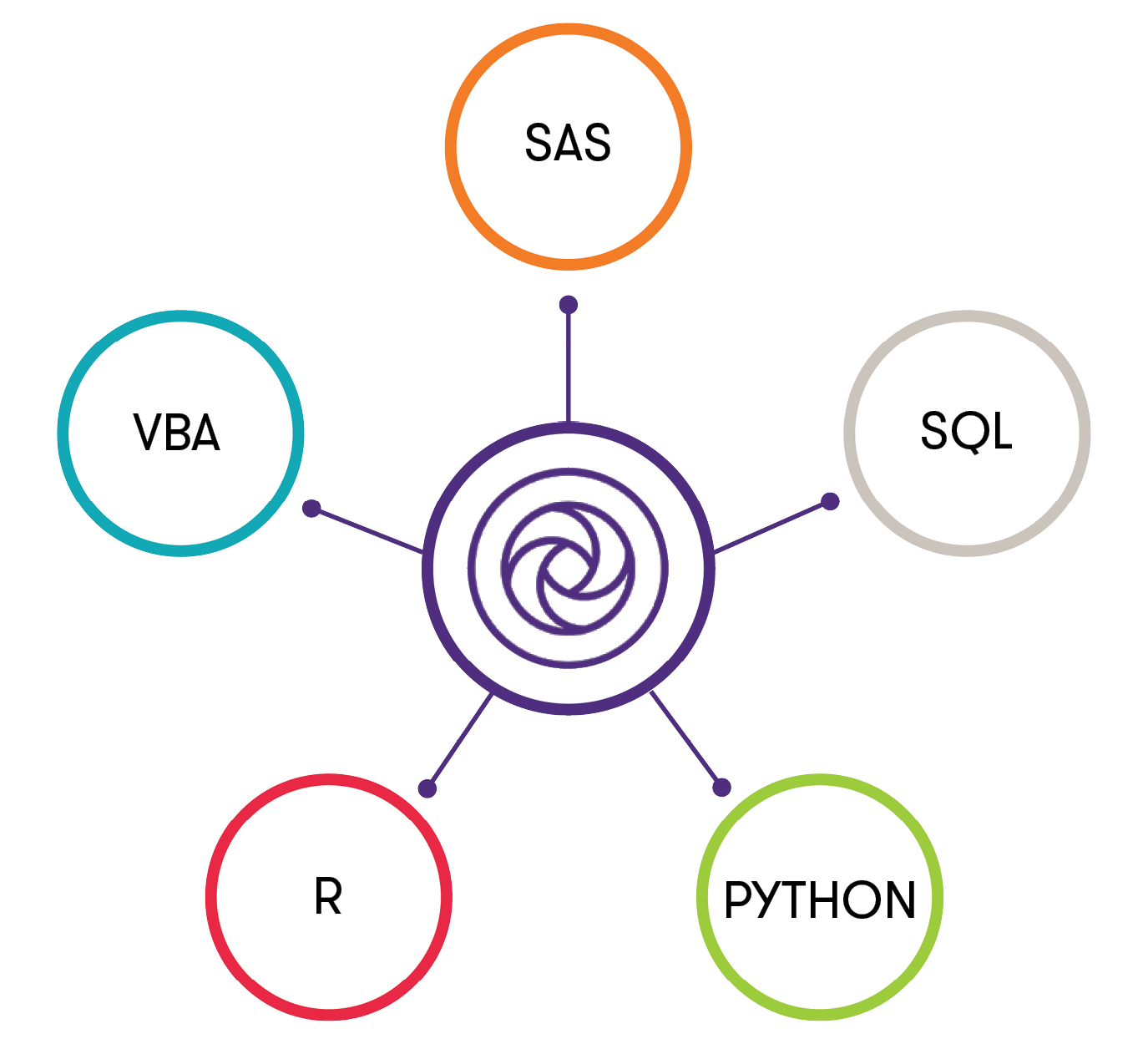

Data science and analytics

As data and data quality are the cornerstone of any successful project, when it comes to data we approach it with the highest attention to detail. Our team of specialists utilises only leading software, technology and methods for data collection, analysis and visualisation.

Our team has extensive experience with key software packages such as:

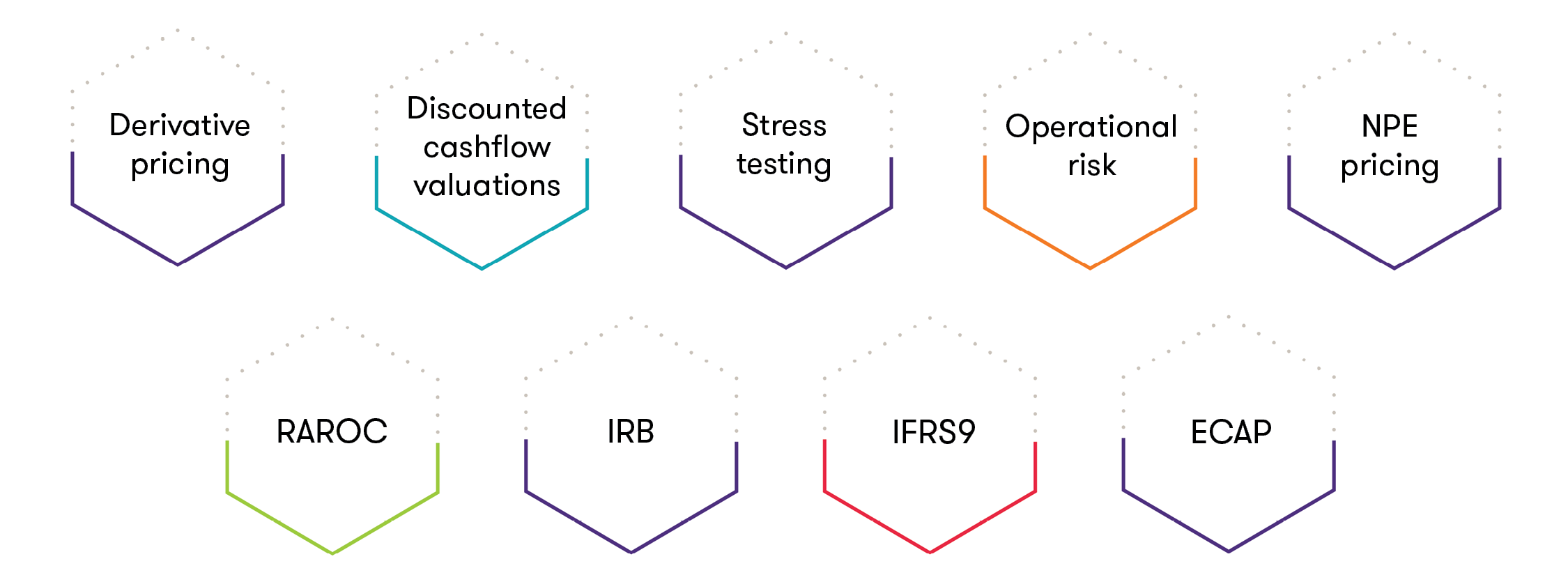

Model development

Our team can provide expert insight into optimal model-build methodologies and offer advice on all relevant regulation. Starting with the initial data preparation stage, through to model development and testing, model documentation and internal governance, we understand the modelling process as a series of sub-processes with mutual dependencies.

Our expert team has extensive experience with the end-to-end delivery of a variety of risk models including:

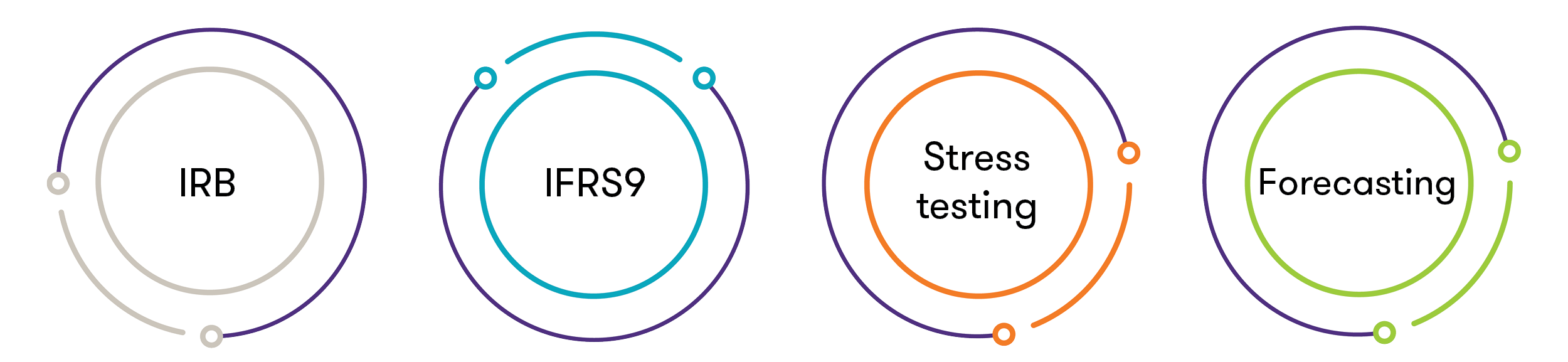

Model validation and assurance

When dealing with model validation and assurance, our offering builds on our depth of statistical model development and data analytics experience, thereby enabling the implementation of robust frameworks for the assessment of the qualitative and quantitative aspects of model design, development and performance oversight.

Our experience in delivering model assurance solutions extends across a broad range of regulatory models and quantitative applications, including:

Portfolio risk management

Grant Thornton’s broad expertise and experience with a variety of risk themes enables clients to build synergies and improve efficiencies across their firm’s risk management framework. The risk management framework itself leverages the combination of our expert knowledge and quantitative methods to improve and enhance the decision-making capability in terms of portfolio composition, risk based pricing, and regulatory reporting and compliance.

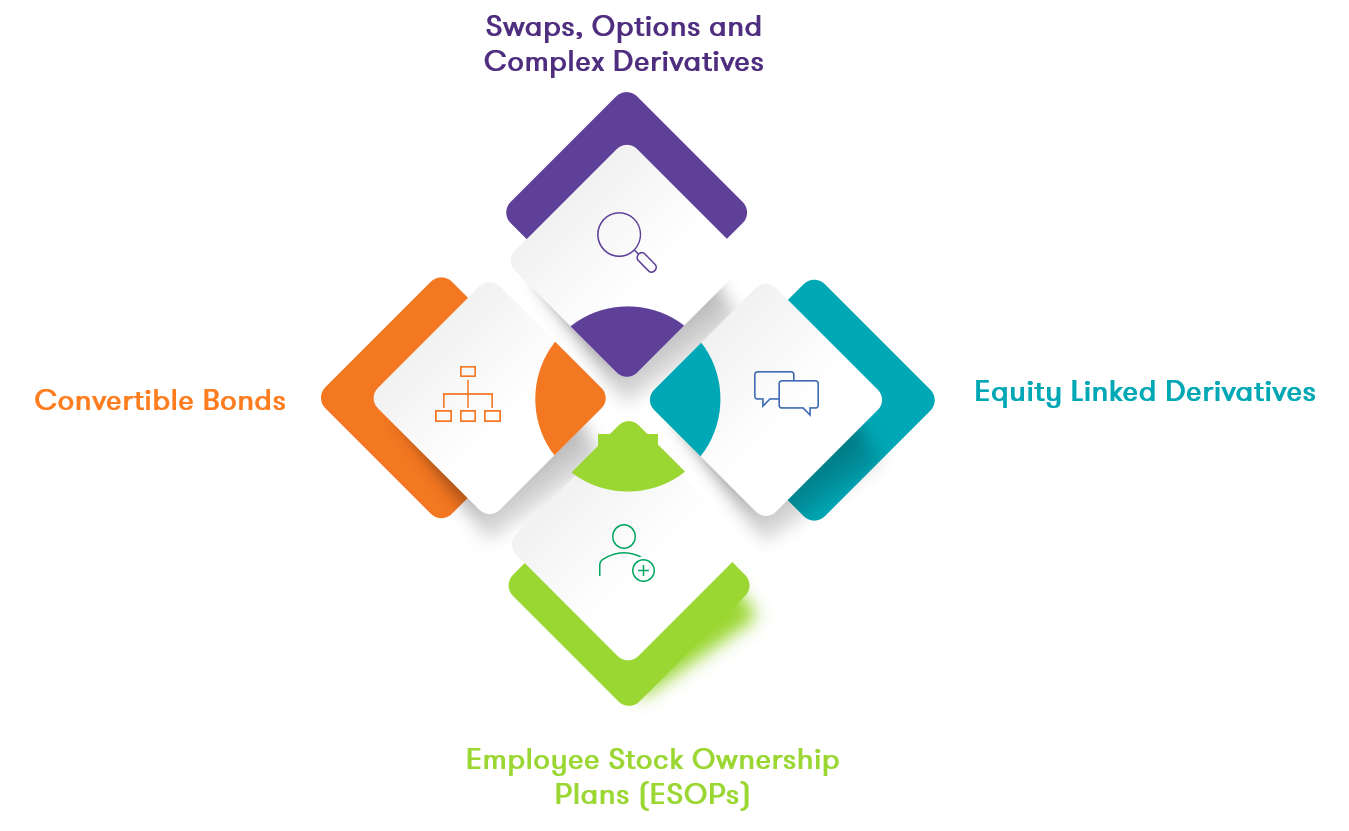

Valuation

As market conditions change rapidly, having consistent and accurate valuations is necessary for many firms across multiple industries and sectors. These complex assets, including; swaps, convertible fixed income securities, equity linked derivatives, and employee stock ownership plans (ESOPs), require rigorous and robust quantitative modelling approaches.

Here at Grant Thornton, our Valuation team has developed and validated models that overcome traditional valuation problems. Our toolkits, use unique and innovative ways to price the securities, all while representing these results in a user-friendly application that allows for easily understandable and seamless valuations. Utilising best industry standards, GT maintain the highest level of delivery while ensuring regulatory compliance.

Our team has extensive experience in the valuation of assets such as: